You are on this page because you want to learn how to trade on Octa in Nigeria, or because you want to read an Octa review. Either way, you are in the right place.

You will also learn how to create an Octa account, how to deposit and withdraw money on Octa, how to trade on Octa, the various Octa fees and commissions involved, and much more. We will also talk about the pros and cons of Octa in Nigeria in 2025.

Without wasting time, let’s go straight to it.

As a Nigerian trader, you can trade all 5 major financial markets on Octa, including Forex, crypto, stocks, commodities, and indices. You can trade 52 currency pairs, gold and silver, 3 energies, 10 indices, 34 cryptocurrencies, and 150 stocks.

What is Octa and How Does it Work?

Octa (formerly known as OctaFX) is an online broker that lets people trade a wide variety of financial markets. Established in 2011, Octa has become popular worldwide, including in Nigeria, due to its low fees, ease of use, and great features.

OctaFX Review: What Makes it Stand Out?

Octa offers a range of trading instruments, including Forex, cryptocurrencies, stocks, indices and commodities. It stands out because it offers competitive spreads, no commission fees, and negative balance protection. In simpler terms, this means you can trade without worrying about paying extra fees for every trade you make, and you won’t lose more money than you have in your account.

If you’re a beginner or even an experienced trader, using OctaFX provides a flexible trading experience, thanks to its multiple platforms like MetaTrader 5 (MT5), and OctaTrader, Octa’s proprietary platform. All these platforms are available on both desktop and mobile, so you can trade on the go. Additionally, OctaFX supports up to 1:1000 leverage, which means you can control larger trades with a smaller initial investment.

As a Nigerian trader, you can trade all 5 major financial markets on Octa, including Forex, crypto, stocks, commodities, and indices. You can trade 52 currency pairs, gold and silver, 3 energies, 10 indices, 34 cryptocurrencies, and 150 stocks.

How Does Octa Work?

At its core, OctaFX lets you trade using Contracts for Difference (CFDs) across a range of asset classes. When you trade CFDs, you’re essentially speculating on the price movements of assets without actually owning the asset itself. This is useful for trading in assets like Forex, stocks, commodities, and cryptocurrencies.

Follow our OctaFX tutorial guide, sign up with Octa today, and enjoy the many benefits of using OctaFX in Nigeria.

Is Octa Available in Nigeria?

Yes, Octa is available in Nigeria. Nigerian traders can easily use OctaFX to trade a variety of assets, including Forex, stocks, commodities, and cryptocurrencies.

- Mobile Access: You can download Octa’s mobile app on Google Play for Android devices and the Apple App Store for iOS devices. The mobile version allows you to trade on the go, access your account, manage positions, and track the markets.

- Desktop Access: For those who prefer trading from their computers, Octa is also accessible via OctaTrader and MT5 platforms. These platforms offer powerful features, charting tools, and real-time data to help you make informed trading decisions.

So yes, you can trade on Octa in Nigeria.

Octa Broker Review in Nigeria (Pros & Cons)

Pros of OctaFX in Nigeria

1. Low Spreads

One of the key advantages of OctaFX is its tight forex spreads. For example, the typical spread for EUR/USD is 0.7 pips, which is quite competitive compared to other brokers. This makes it an attractive choice for traders who want to minimize costs.

2. Good Research Materials

OctaFX offers a variety of educational resources and research materials, such as daily trading updates, weekly forecasts, and third-party content. These can be extremely useful for traders looking to make informed decisions.

3. 24/7 Customer Support

OctaFX provides 24/7 customer support through live chat and email. Whether you’re a new trader or experienced, the support team is available to assist you with any queries.

4. No Inactivity and Swap Fees

OctaFX does not charge inactivity or swap fees. This is especially beneficial for traders who may not trade frequently or those using long-term trading strategies without incurring additional costs.

5. Free Deposits and Withdrawals

With OctaFX, you can deposit and withdraw funds free of charge using local payment methods in Nigeria. This feature makes it an easy choice for Nigerian traders, as you don’t have to worry about extra fees eating into your profits.

6. Multiple Trading Platforms

OctaFX offers multiple platforms like MT5, and its proprietary OctaTrader platform, giving traders flexibility to choose the platform that suits their needs. The platforms are available on both mobile and desktop, allowing traders to stay connected to the markets anywhere.

7. Negative Balance Protection

OctaFX provides negative balance protection, meaning you can never lose more than what is in your trading account. This feature provides an extra layer of security for traders who are concerned about significant losses.

8. Sharia-Compliant Accounts

OctaFX offers swap-free trading accounts for traders who need a Sharia-compliant account, making the platform accessible for Muslim traders in Nigeria.

Cons of OctaFX in Nigeria

1. Unregulated Offshore Entity

While OctaFX is regulated in several jurisdictions like MISA and CySEC, it also operates through offshore entities, which may not provide the same level of security and protection as more established regulators.

2. Limited Asset Selection on Some Platforms

OctaFX offers a limited range of tradable assets on platforms like OctaTrader, with only about 80 pairs available. This could be a disadvantage for traders looking for more variety in their trading instruments. However, MT5 offers a broader selection of 52 currency pairs, which may suit advanced traders better.

3. No Phone Support

While OctaFX provides customer support through email and live chat, there is no phone support available. This might be an inconvenience for traders who prefer to speak directly to someone.

4. Limited Deposit Methods

While OctaFX offers a variety of payment options, the deposit methods are still limited compared to some other brokers. Nigerian traders might find fewer options when it comes to making deposits or withdrawals.

5. Lack of Advanced Educational Tools for Forex

OctaFX provides educational resources, but they might not be as comprehensive as some other platforms. If you’re looking for in-depth forex educational tools, you may need to seek additional resources outside of OctaFX.

Also Read

How To Trade On HFM In Nigeria: Broker Review 2025, Create Account, Trade, Deposit, Withdraw and Lots More

How To Trade On HFM In Nigeria: Broker Review 2025, Create Account, Trade, Deposit, Withdraw and Lots More

What Can I Trade on Octa?

When you trade on OctaFX, you have access to a wide range of tradable instruments. Depending on the account type you choose, the number of available instruments varies. Here’s a breakdown of what you can expect to trade on OctaFX:

1. OctaTrader Account Type

Instruments Available on OctaTrader

- Currency Pairs (35). These are pairs like EUR/USD, GBP/USD, and others that you can trade on the forex market.

- Gold and Silver. Both gold and silver are popular commodities that can be traded as CFDs.

- Energies (3). OctaTrader offers energy commodities like crude oil for trading.

- Indices (10). You can also trade indices, which represent a group of stocks from specific sectors or regions.

- Cryptocurrencies (30). For those interested in the crypto market, OctaFX offers 30 different cryptocurrencies to trade, including Bitcoin, Ethereum, and many others.

Account Features

- Spread: Starting from 0.6 pips (a small cost per trade)

- Commission: $0 (no additional charges for trades)

- Deposit/Withdrawal Fees: None

- Minimum Deposit: $25 (though $100 is recommended)

2. MT5 Account Type

Instruments Available on MT5

- Currency Pairs (52). MT5 offers more currency pairs than the OctaTrader account type, giving you more options for forex trading.

- Gold and Silver. Just like on OctaTrader, you can trade precious metals like gold and silver.

- Energies (3). Crude oil and other energy commodities are available for trading.

- Indices (10). A variety of indices from major financial markets are available.

- Cryptocurrencies (34). MT5 offers a larger selection of cryptocurrencies, including some of the biggest names in crypto.

- Stocks (150). MT5 gives you access to 150 stocks, allowing you to trade shares from major companies worldwide.

- Intraday Assets (26). There are 26 assets you can trade on a shorter time frame, perfect for day traders.

Account Features

- Spread: Starting from 0.6 pips (low trading cost)

- Commission: $0 (no additional charges for trades)

- Deposit/Withdrawal Fees: None

- Minimum Deposit: $25 (recommended $100)

How to Create an Octa Account in Nigeria (Step-by-Step Guide with Screenshots)

If you’re interested in trading on Octa in Nigeria, here’s a simple step-by-step guide to get you started. We’ll break down the process, and use the screenshots provided to guide you through it. Let’s get started.

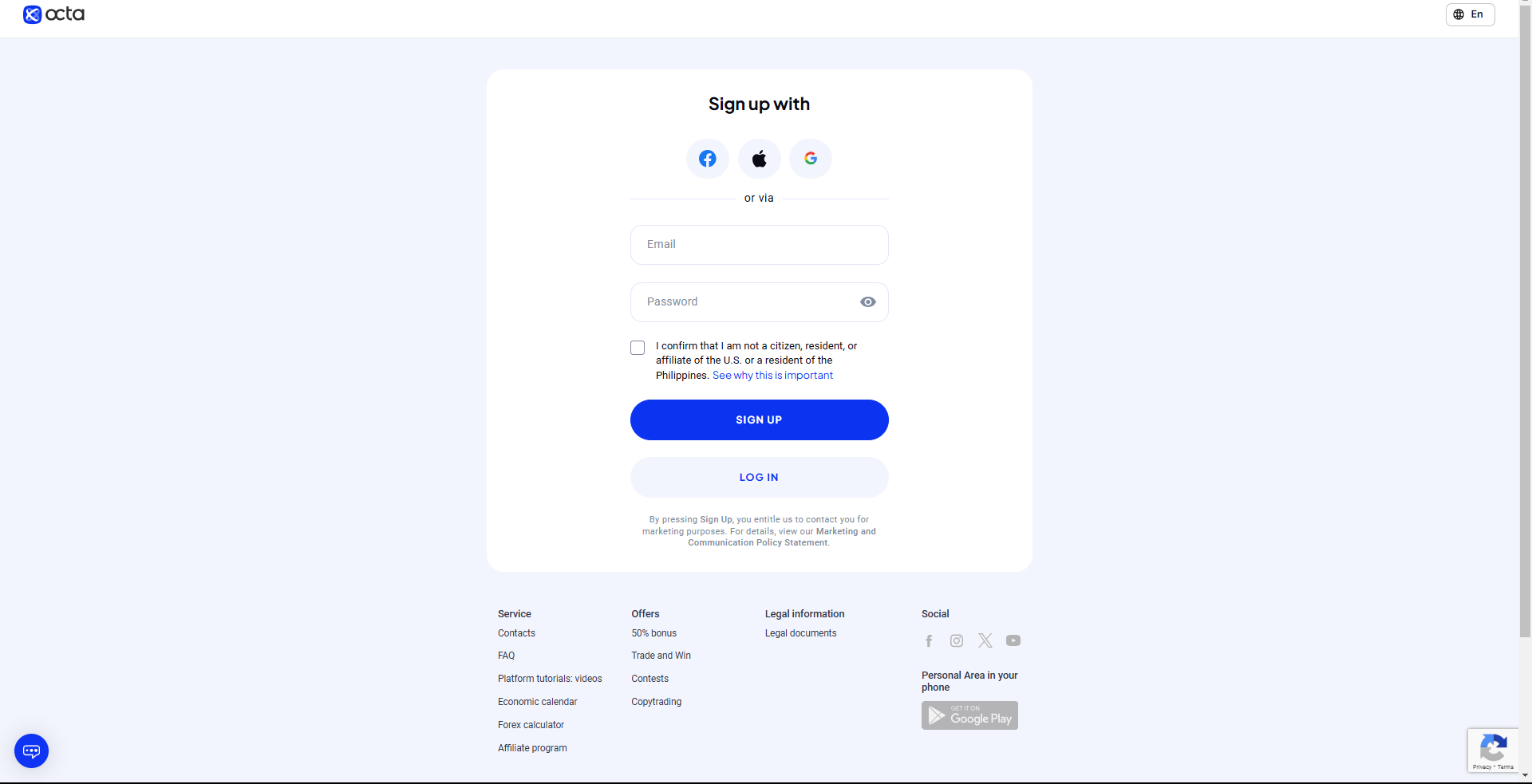

Step 1: Visit the Official Octa Website and Click “Open Account”

The first step is to go to the official Octa website. Once you’re there, look for the “Open Account” button on the homepage. This is where your journey begins.

Screenshot 1: The Octa website homepage with the “Open Account” button visible.

Click the button, and you’ll be directed to the sign-up page.

Step 2: Sign Up

Now, you’ll need to fill out a few important details to register. The required fields typically include:

- Your name.

- Email address.

- Phone number.

You’ll then have the option to choose between opening a real or demo account. A demo account is great if you’re new to trading and want to practice without using real money.

Once you’ve filled in your details, Octa will send a confirmation email to the address you provided. Open your email inbox, find the email from Octa, and click on the confirmation link inside.

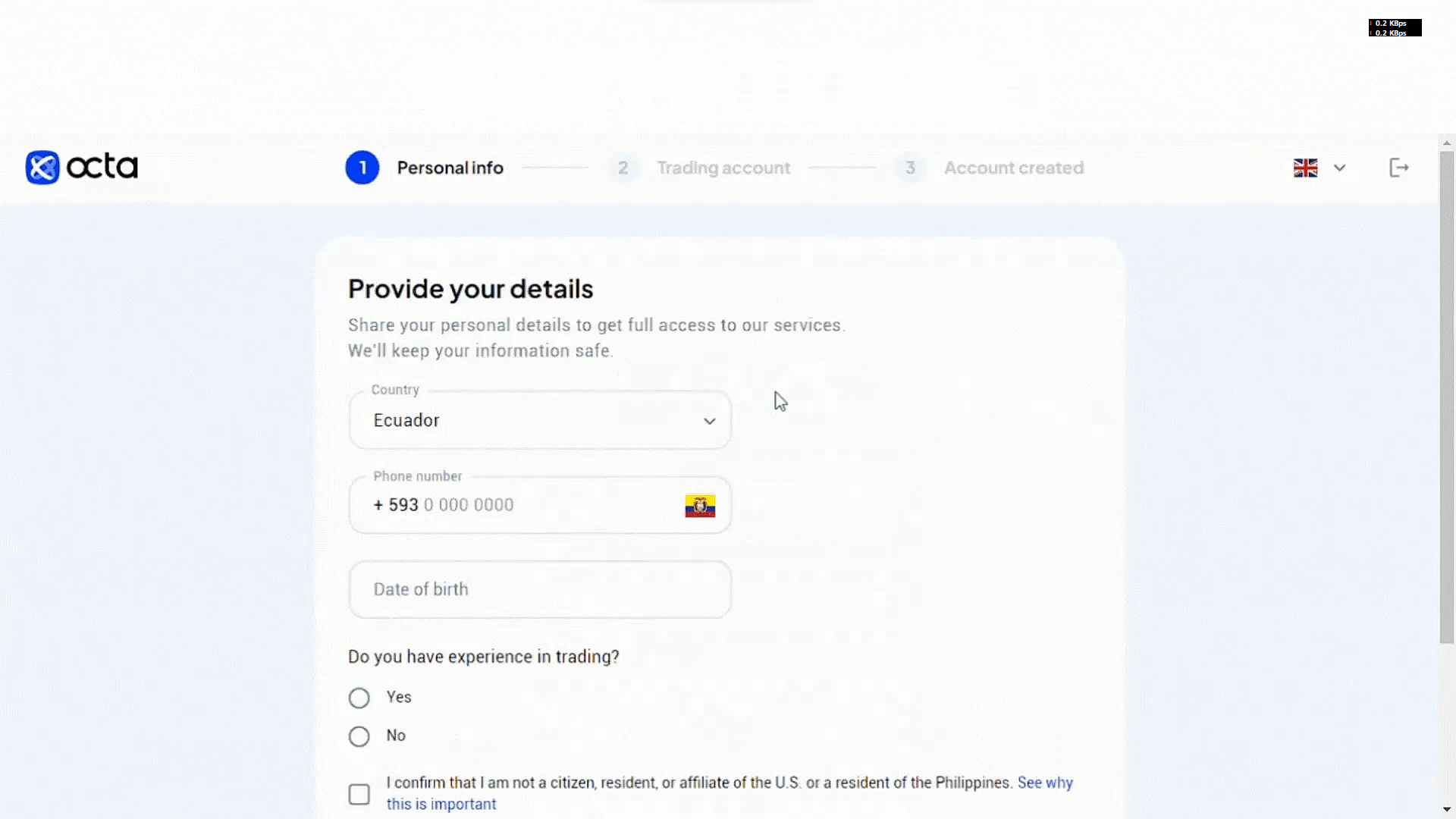

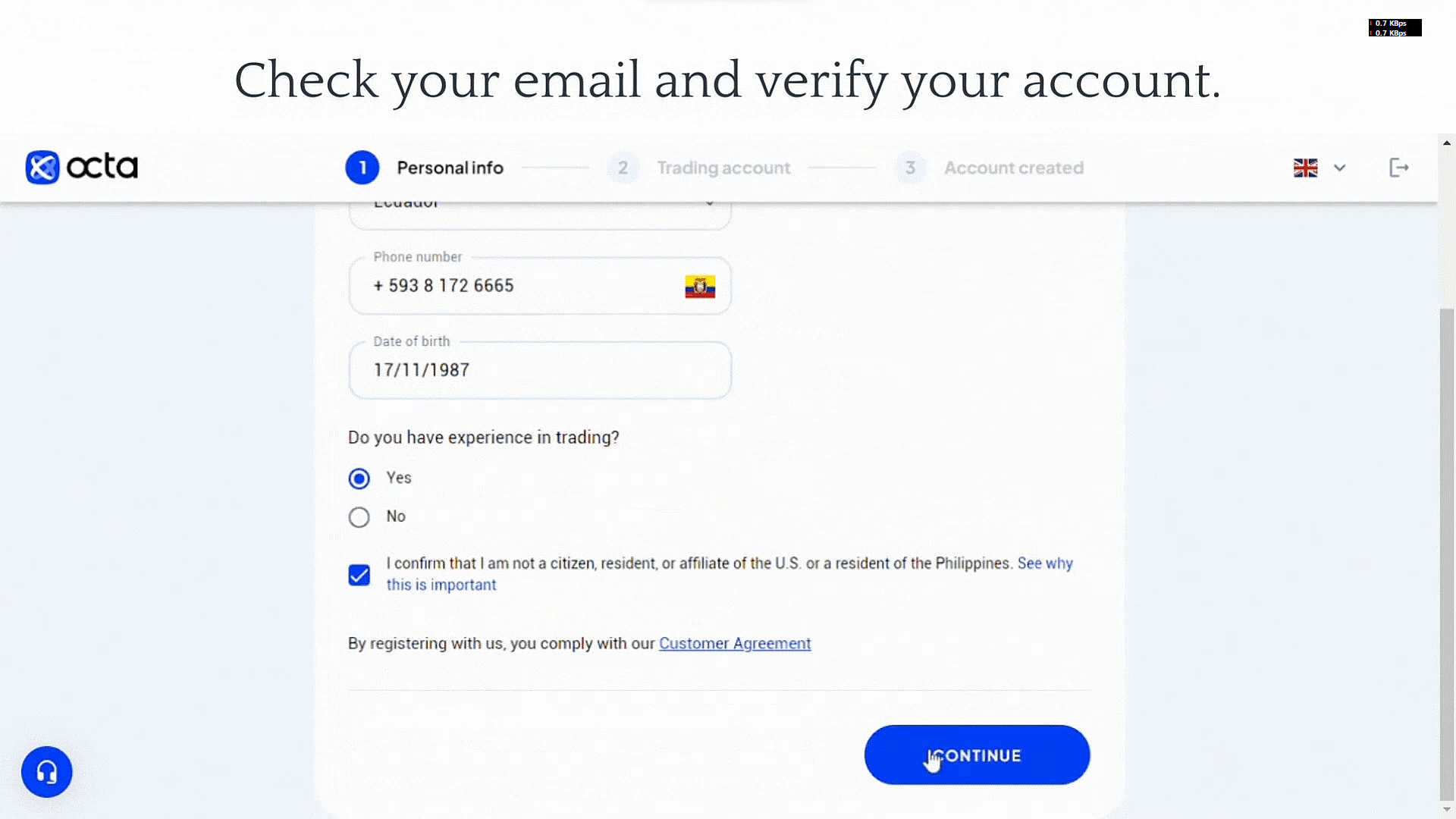

Step 3: Set Up Your Trading Account

After verifying your email, follow the on-screen instructions to complete the setup. You’ll be asked to set up your trading account, where you’ll choose your platform (such as OctaTrader or MT5) and other preferences like currency and leverage.

You will also need to deposit funds into your account to start trading. The minimum deposit is typically around $25, but for optimal trading, it’s recommended to deposit $100.

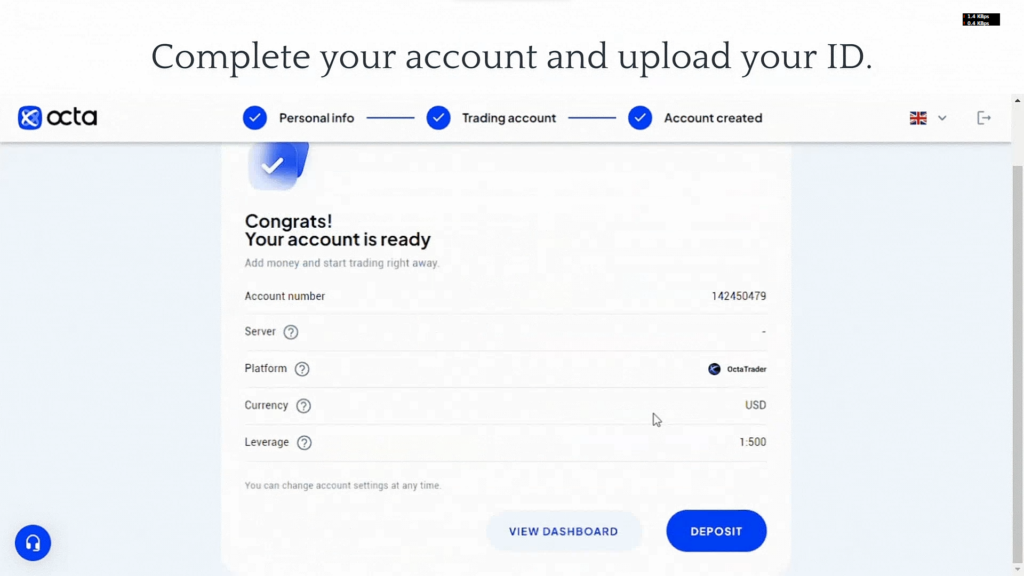

Screenshot 3: Complete your account setup with necessary information.

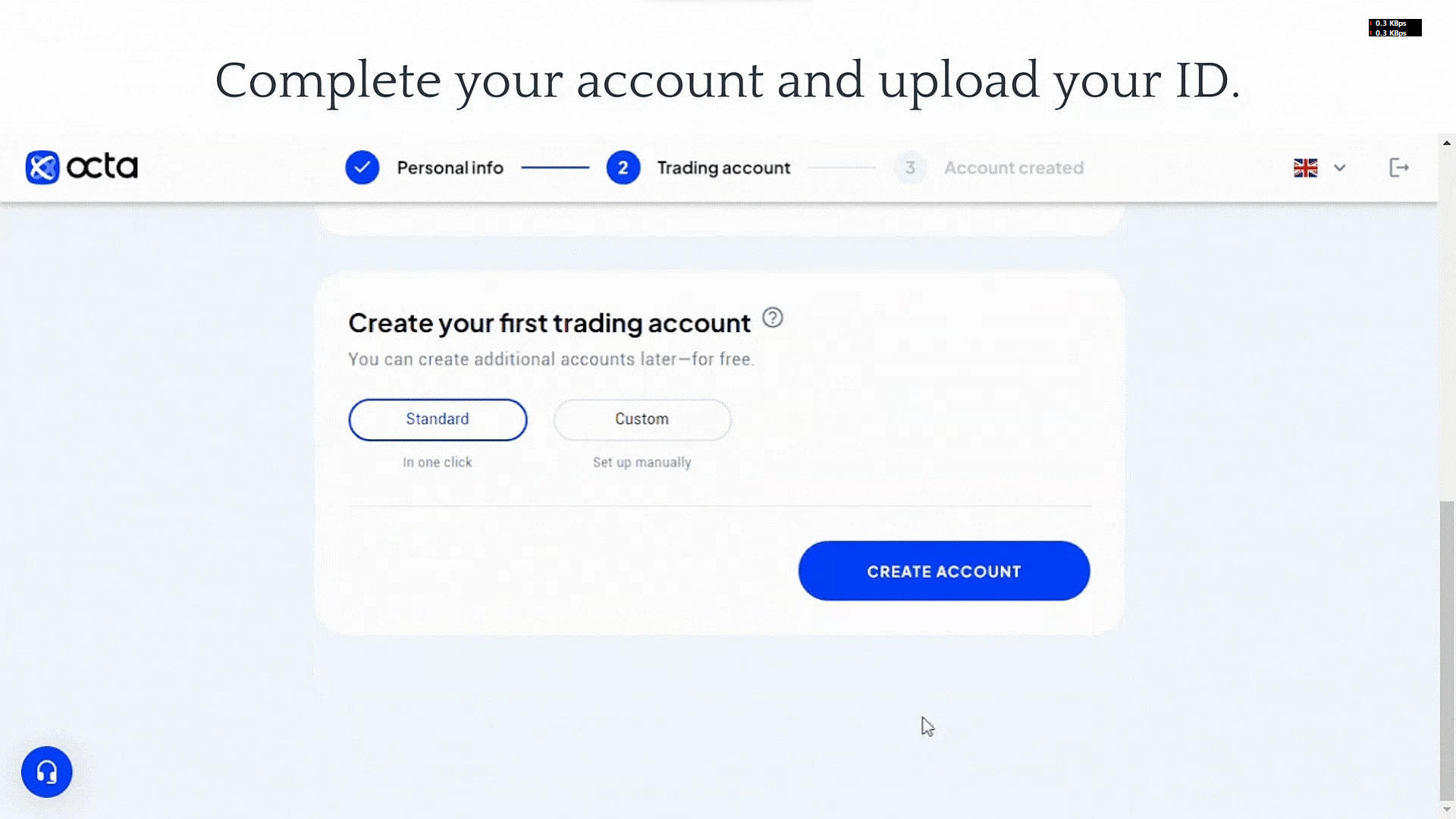

Step 4: Upload Your ID for Verification

To fully complete your account, Octa requires you to upload identification documents. This step is essential to verify your identity, especially if you want to make withdrawals from your account. You’ll need to provide a clear copy of your ID (passport, driver’s license, or any valid identification).

Screenshot 4: Uploading your ID for verification to fully activate your account.

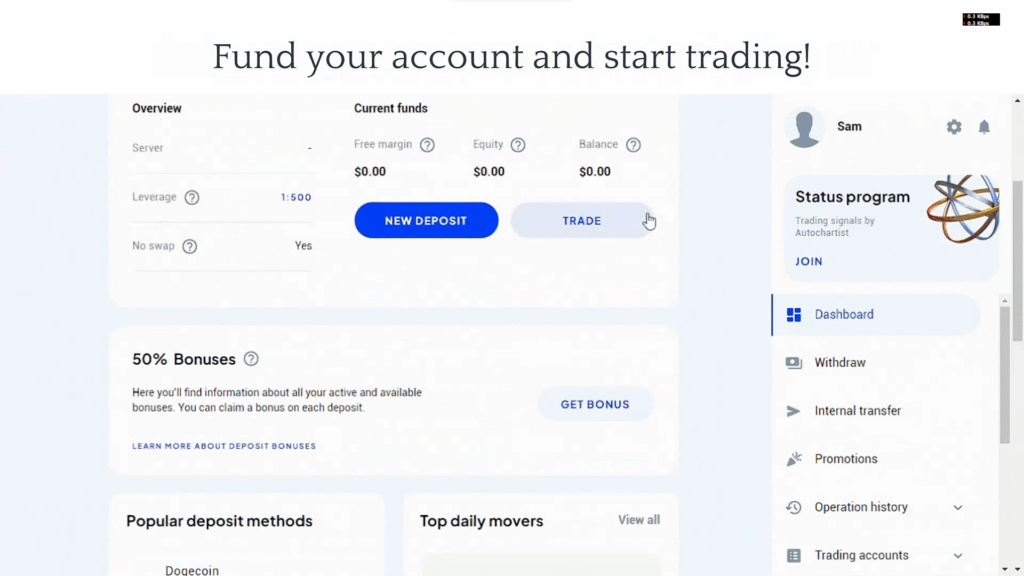

Step 5: Start Trading

Once your account is created and verified, you’ll be able to access your trading dashboard. You can then choose between different trading platforms like OctaTrader, or MT5 to start trading.

Screenshot 5: Once everything is set up, your account is ready, and you can start trading.

Now that your account is ready, you can begin making deposits and start trading in various markets, such as forex, cryptocurrencies, commodities, and more!

How to Close Your Octa Account

If at any point you want to close your account with Octa, follow these steps:

- Go to the “Contact Us” section of the website.

- Reach out to customer service via live chat, email, or social media.

- Inform them that you’d like to close your account, and they will guide you through the process.

- Make sure to settle any ongoing trades and clear any outstanding fees.

They may also ask for additional verification documents to confirm your identity before proceeding with the closure.

How to Verify KYC on Octa in Nigeria

Verifying your KYC (Know Your Customer) on Octa is a needed step to activate your trading account, withdraw funds, and access full trading features. Here’s a straightforward guide on how to complete the verification process both on the web and through the Octa Trading App.

1. Start a New Verification Request

Begin by logging into your Octa account, either on the web or through the Octa Trading App. From your dashboard, locate the option to start a new verification request.

2. Select the ID to Submit

Octa allows you to submit one of the following IDs for verification:

- NINS (National Identification Number)

- Passport

- Driver’s License

- Other Documents

3. Upload Photos of Your ID Document

To complete the verification, follow these steps:

- For NINS: Take a picture of the front side of your National ID card.

- For Passport: Capture the front side of your passport.

- For Driver’s License: Take a photo of the front side of your driver’s license.

- For Other Documents: Ensure you capture both the front and back sides of the document.

Make sure to:

- Ensure that all four corners of your document are visible.

- Ensure that the text is clear, readable, and in focus.

- The image should be bright and clear. Your face must also be clearly visible.

- The photo should be in JPG format with a maximum size of 10MB.

4. Upload Your Birth Certificate

For verification with NINS (as it doesn’t display your birth date), you’ll need to upload a secondary document—your Birth Certificate. Here’s how:

- Take a picture of the front side of your Birth Certificate.

- Upload it in JPG format (under 10MB).

5. Press Submit Request

Once all your documents are ready, click on the Submit Request button. Octa will then review your documents.

6. Wait for Verification

Octa usually takes a few minutes to process your verification. However, in some cases, it may take up to two hours. You’ll receive an email notification once your verification is complete.

Tips for Successful Octa KYC Verification

- Ensure both documents are uploaded: Your ID and Birth Certificate. If one of them is missing, your verification cannot be processed.

- Take clear, focused photos: If the ID photo quality is poor, take another one. If the text is hard to read, submit a supplementary document (like Improved NINS, Digital NINS, or a West African Examinations Council ID).

- Selfie Verification: If your face on the ID is unclear, take a selfie with the ID. Make sure the document is clearly visible in the photo.

- Check the Image Quality: Do not edit the photo. Use default camera settings, and ensure your document is in full view, clearly focused, and well-lit.

7. Re-upload and Retry if Necessary

If your documents are not accepted, you will be given instructions on how to fix the issues. If you see any errors, follow the email instructions, upload the required images again, and submit a new request.

8. Important Note on Account and Personal Area

Octa allows only one profile per person. Multiple profiles are not permitted as per international law. If you lose access to your personal area, use the “Forgot Password” option to recover your account.

Once your account is verified, you’re ready to deposit funds and start trading on OctaFX. If you encounter any issues, you can always contact Octa’s customer support for further assistance.

Also Read

Gate.io In Nigeria: Broker Review, Create Account, Trade, Deposit, Withdraw and Lots More

How To Trade On Gate.io In Nigeria: Broker Review, Create Account, Trade, Deposit, Withdraw and Lots More

How to Deposit Money on Octa in Nigeria

Depositing funds into your Octa account is a simple and straightforward process. Whether you want to fund your Octa trading account through local bank transfers, e-wallets, or credit cards, here’s a step-by-step guide to help you deposit on Octa with ease.

1. Log In to Your Octa Account

To get started, log into your OctaFX account on the web or the Octa trading app. Once you’re logged in, navigate to the dashboard and click on the New Deposit button.

2. Select Your Account to Deposit Into

After clicking on the New Deposit button, you’ll be prompted to select which account you want to top up. Make sure you select the correct trading account for your deposit.

3. Choose Your Payment Method

Now, you’ll need to choose how you want to fund your Octa account. OctaFX supports several payment methods, and the list may vary depending on your location. Here are the most common options:

4. Deposit via Local Bank Transfer (For Nigerian Traders)

- If you’re using a local bank transfer in Nigeria, choose the Local Bank option or select your specific bank from the list provided. If you don’t see this option, ensure your account is verified and try again.

- Specify the amount you want to deposit.

- You can adjust the bonus percentage at this stage if applicable.

- To make the actual transfer, use your online banking app, visit an ATM, or go to your bank branch. Be sure to use the bank details provided on the Octa deposit page.

- Once the transfer is complete, return to the OctaFX platform, click Notify Us After Transfer, and fill out the necessary details (amount, bank account number, payment date).

- You can speed up the process by uploading a payment document.

- Local bank deposits usually take 1-3 hours but may take longer on rare occasions.

5. Deposit via Credit Card or E-Wallet

- Choose Visa, MasterCard, or your preferred e-wallet. The options available to you depend on your region.

- Enter the amount you want to deposit.

- Adjust the bonus percentage if needed.

- Complete any additional payment details required.

- Follow the instructions provided by the payment service page to complete the transaction. Deposits made through cards and e-wallets are processed almost instantly, though sometimes it may take up to 30 minutes.

6. No Fees on Deposits

Octa does not charge any deposit or transaction fees. However, your payment provider might charge their own fees, so be sure to check with them before proceeding with your deposit.

7. How to Deposit to Your Octa Demo Account

Demo accounts use virtual funds for practice trading. Therefore, you don’t need to deposit any real money. If you want to top up your demo account, simply select it from your profile and click the Top Up button.

8. Waiting for Your Deposit to Process

- Deposits via cards, e-wallets, and other payment methods are usually processed within minutes but can sometimes take up to 30 minutes.

- Bank transfers take between 1-3 hours to process, but in some cases, they might take up to one business day.

9. What to Do if Your Deposit is Delayed

- If your deposit is taking longer than expected, give it some time as each payment method has its own processing time.

- If there’s a significant delay, or if you encounter any issues, reach out to OctaFX’s customer support for assistance.

How to Withdraw Money from Octa in Nigeria (Step-by-step Guide with Screenshots)

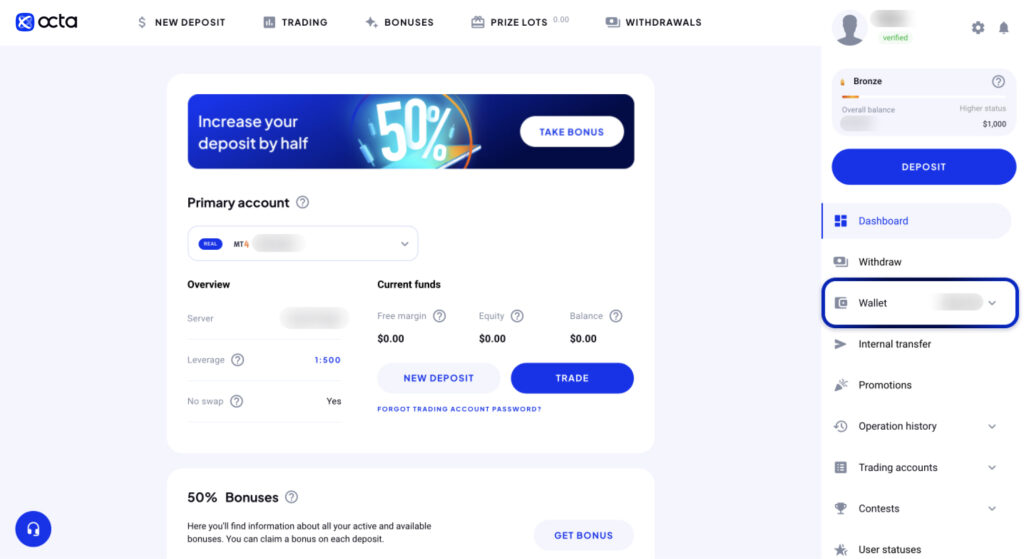

Withdrawing your funds from Octa is a straightforward process. Before you proceed, ensure that your profile is verified, as this is a requirement for withdrawal according to the law. Here’s how you can withdraw money from your trading account or wallet:

1. Log in to Your Personal Area

- First, log in to your personal area on Octa’s official site using your credentials.

2. Choose Your Withdrawal Method

- From Your Wallet:

- On the right-hand menu, click on “Wallet.”

- Then, select the “Withdraw” option.

- From Your Trading Account:

- Select the account you want to withdraw money from.

- Press the “Withdraw” button.

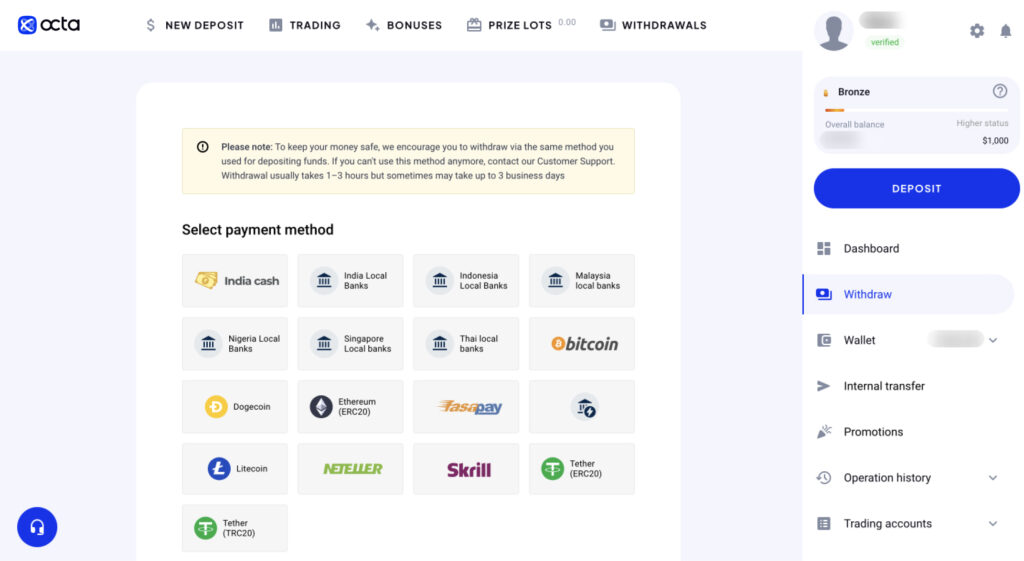

3. Select Your Preferred Payment Method

- You will see a list of payment options available in your region. Choose the one that suits you best and click “Next.”

- Withdrawal options include bank transfers, e-wallets (like Neteller, Skrill), and cryptocurrencies (such as Bitcoin).

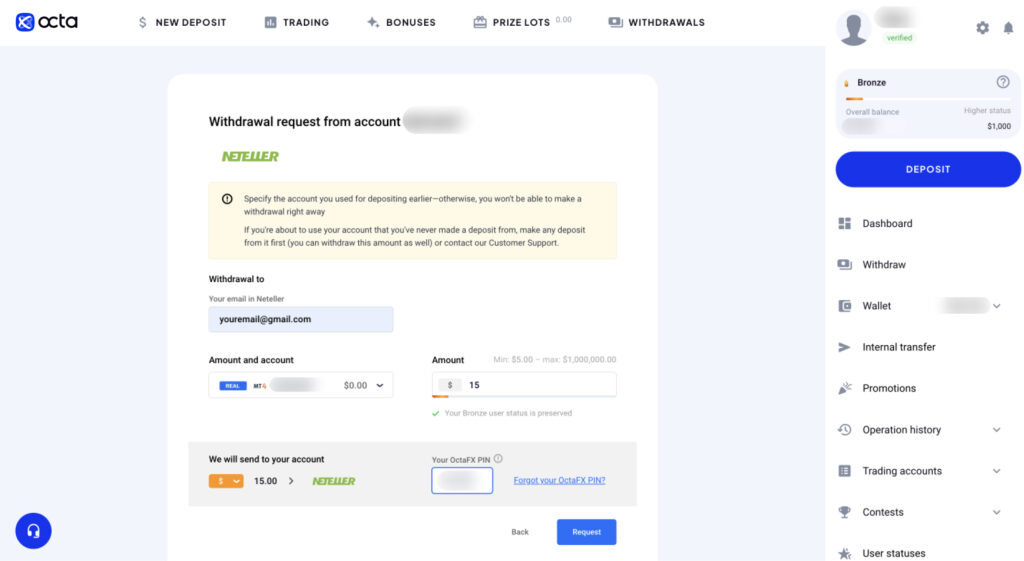

4. Enter Withdrawal Details

- For e-wallets like Neteller, Skrill, and Perfect Money, the minimum withdrawal is $5. For Bitcoin, it’s 0.00096 BTC. Visa requires a minimum withdrawal of $20 or the equivalent in other currencies.

- Enter the required payment details (e.g., account number, e-wallet email, amount, and currency).

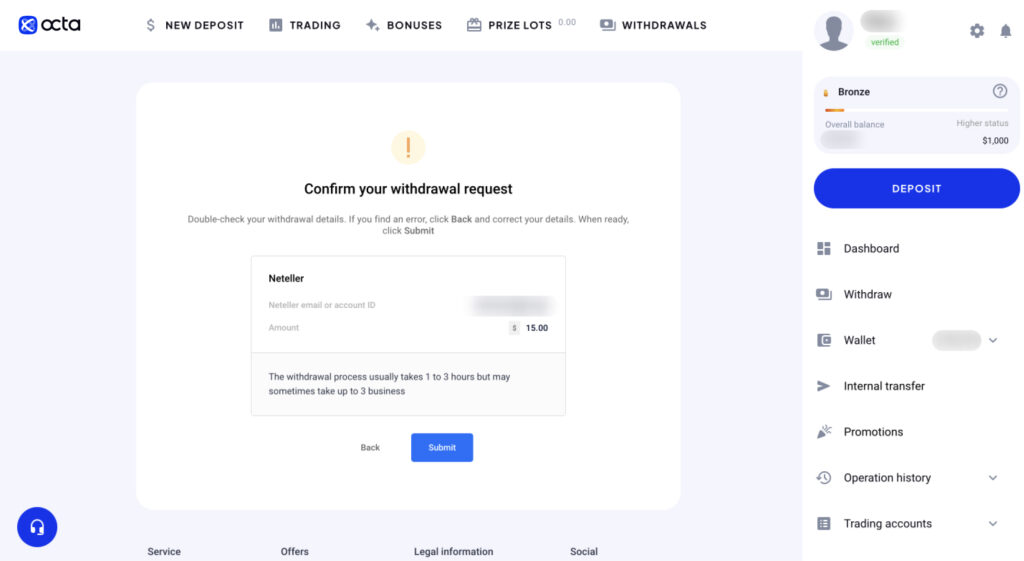

5. Double-Check Your Withdrawal Information

- Before submitting the request, carefully review the entered information to ensure everything is accurate.

- Click “Submit” to complete the process.

6. Wait for Confirmation

- The withdrawal process typically takes 1–3 hours. However, it may take longer, depending on the payment method you used.

- You’ll receive an email and a notification in your personal area once the money has been sent.

Key Notes:

- No Withdrawal Fees: Octa does not charge any fees for withdrawals, but your payment provider may have its own charges, so be sure to check that.

- Withdrawal Limits: For e-wallets and cryptocurrencies, there are no maximum withdrawal limits, while Visa withdrawals are subject to a minimum of $20.

Troubleshooting:

- If your withdrawal is delayed, wait for up to 30 minutes, as different payment methods have varying processing times.

- If it takes longer than expected or if there are any issues, contact OctaFX Customer Support for assistance.

With this guide, you’ll be able to withdraw your funds smoothly and efficiently. Always ensure that your account details are correct, and if needed, reach out to OctaFX support for any issues regarding withdrawals.

How to Start Trading on OctaTrader via Web or the Octa Trading App

OctaTrader is the trading platform offered by OctaFX. It is easy to use and available both on the web and via the Octa Trading App for your mobile device. Here’s how you can start trading on OctaTrader:

1. How to Open Your OctaTrader Account

To start using OctaTrader, you need to create an account:

- Log in to your Octa profile.

- From your profile, click the option to Open New Account.

- On your mobile device, open the Accounts tab, and press the ‘+’ button.

- Choose OctaTrader as your trading platform.

- Select your account type (Demo or Real) and leverage ratio.

- Click Create Account and proceed to make your first deposit.

2. How to Access the OctaTrader Platform

Once your account is set up, you can start using the platform:

- Web Version: From your Octa account, select the OctaTrader account from the list, and click Trade. This will open the platform in a new tab.

- Mobile App: Open the Accounts tab, choose your OctaTrader account, and press Trade.

3. Making Your First Deposit

Before you can start trading, you need to deposit funds into your account:

- Go to the Accounts tab and press Deposit.

- Choose your preferred payment method and deposit the funds.

4. How to Use the OctaTrader Web Tools

Once you’re in the platform, you’ll see several helpful tools. Here are some important ones:

Chart Window

- Displays the current market prices.

- You can change the chart style (bars, candles, etc.) and timeframes.

- Tools for adding trend lines and Fibonacci retracement are also available.

Market Watch

- Shows the available trading instruments, including their current prices.

- You can use the search bar to find specific instruments and apply filters like Forex, Crypto, and Metals.

- To open an order, select an instrument, set your lot size, and press Sell or Buy.

How Stop Loss and Take Profit Work

- Stop Loss: Automatically closes your trade to prevent further losses if the market goes against you.

- Take Profit: Closes your trade when the market reaches a price where you’ve locked in profits.

- Set these levels in the Orders section by clicking on the Edit Order menu.

5. How to Use OctaTrader Indicators

OctaTrader offers various technical indicators to help with your analysis:

- To add an indicator, go to Indicators and select one.

- You can customize or remove indicators by clicking on the three dots icon next to the indicator name.

6. How to Close an Order

To close an order, follow these steps:

- Web Platform: In the Orders section, find your open order and click Close Now or Close Partially.

- Mobile App: Find the order in the Orders tab, press the Close icon and set the number of lots to close partially.

7. How to Use Octa’s Forex Trading Tools

Octa provides several helpful tools:

- Economic Calendar: Keep track of important financial events.

- Trading News: Stay updated with the latest market news.

- Trading Calculators: Use the Profit Calculator to estimate your potential profit or loss, and the Margin Calculator to calculate the margin required to open a position.

With these tools, you can manage your trades effectively and make better decisions. Start trading with OctaTrader today and use the platform’s powerful tools to enhance your trading experience.

Also Read

How to Trade on Bybit in Nigeria: Review, Create Account, Trade, Deposit, Withdraw, Spot Trade, Derivatives and More

How to Trade on Bybit in Nigeria: Review, Create Account, Trade, Deposit, Withdraw, Spot Trade, Derivatives and More

How to Start Trading on MetaTrader 4 or MetaTrader 5 for PC

MetaTrader 4 and MetaTrader 5 are popular trading platforms used by many traders. You can use them for desktop trading with Octa. Here’s a simple guide to help you get started:

1. Web-based vs. Desktop Trading

- Web-based trading: You don’t need to install any software. Just use your browser to access the MetaTrader web terminal and start trading right away.

- Desktop trading: You need to download and install MetaTrader 4 or MetaTrader 5 on your computer. It has more features, faster performance, and supports more chart windows.

2. How to Choose Between MetaTrader 4 and MetaTrader 5

- MetaTrader 4: Popular and simple to use, best for beginners.

- MetaTrader 5: More advanced with additional features like stocks, Level 2 market depth, and partial fills.

Both platforms offer Forex, commodities, indices, and cryptocurrencies, with the same leverage (1:500) and spreads starting from 0.6 pips.

3. How to Install MetaTrader on Your Computer

For Windows:

- Download MetaTrader 4 for Windows or MetaTrader 5 for Windows.

- Run the installer and follow the setup instructions.

For Mac:

- Download MetaTrader 4 for Mac or MetaTrader 5 for Mac.

- Open the installer, then drag the file to the Applications folder. You can now start trading on your Mac.

4. How to Log In to Your MetaTrader Account

- Open a New Account: When you first open MetaTrader, don’t create a new account directly in the app. Instead, go to Octa’s profile and click Open New Account.

- Login: You will receive an email with your login details and password. To log in, follow these steps:

- Open MetaTrader.

- Click File > Login to Trade Account.

- Enter the login and password from the email and select the server provided.

5. How to Use Key Tools in MetaTrader

Menu Panel

At the top, you’ll find a toolbar with options to apply indicators, change chart appearance, and place orders.

Chart Window

Shows current market prices. You can toggle the Bid and Ask prices, and use tools like trend lines or Fibonacci retracement.

Market Watch

- On the left, it lists available trading instruments with their Bid and Ask prices.

- You can search for specific instruments and add them to the chart by right-clicking.

Terminal (or Toolbox in MetaTrader 5)

Located at the bottom, it shows important information about your orders and account, such as balance, equity, and margin.

6. How to Place an Order in MetaTrader

To place an order:

- Click New Order or press F9.

- Select the asset, enter the lot size (volume), and choose whether you want a Market Order or a Pending Order.

- Set Stop Loss and Take Profit levels to manage your risks.

- Press Buy (blue button) or Sell (red button) to execute your trade.

7. How Stop Loss and Take Profit Work

- Stop Loss: Automatically closes your trade if the market moves against you to limit your losses.

- Take Profit: Closes your trade when the market reaches a price that locks in your profits.

- You can set or change these levels by right-clicking on the order in the Trade tab and selecting Modify Order.

8. How to Use Indicators in MetaTrader

MetaTrader comes with many technical indicators like trend indicators, oscillators, and volumes. To add one:

- Go to Insert > Indicators and choose the one you need.

- To remove an indicator, right-click on it and select Delete Indicator.

9. How to Close an Order in MetaTrader

To close an order:

- In the Trade tab, find your open order and click the X at the end of the row.

- Alternatively, right-click the order and choose Close Order to exit at the current market price.

10. How to Deposit and Start Trading

Before you can trade, you’ll need to deposit funds into your account. Here’s how:

- Deposit via the Octa profile by selecting the Deposit option and choosing your preferred method.

- The minimum deposit is 25 USD, but for new traders, it’s recommended to deposit at least 100 USD.

11. How to Use Trading and Profit Calculators

- Profit Calculator: Helps you estimate potential profits or losses for any order.

- Margin Calculator: Shows the required margin to open a position. It’s crucial for balancing your risks and managing leverage.

Also Read

How to Trade on Bybit in South Africa: Bybit Review 2025, Create Account, Trade, Deposit, Withdraw, Spot Trade, Derivatives and More

How to Trade on Bybit in South Africa: Review, Create Account, Trade, Deposit, Withdraw, Spot Trade, Derivatives and More

How to Trade Indices on OctaFX

Index derivatives are financial products that allow traders to earn from the fluctuations of stock markets. With OctaFX, you can trade indices with high leverage and flexible hours, making it an exciting opportunity for those familiar with Forex trading.

What are Index Derivatives?

An index is a measure that shows how a group of stocks in a market or sector is performing. It’s a way to track the overall movement of the stock market without directly buying the individual stocks. You can trade these movements using derivatives, which reflect the performance of the index.

Indices can be classified in many ways:

- National (for a specific country)

- Global (spanning across countries)

- Industry-specific (focused on one industry like technology or energy)

- Exchange-based (based on specific stock exchanges)

There are different types of indices, such as price-weighted, market-cap weighted, and equally-weighted, each with a unique method of calculation.

How to Trade Indices

To trade index derivatives with OctaFX, you can use the MT5 trading platform, which support indices such as:

- Dow Jones (US30)

- S&P 500 (SPX500)

- Nasdaq 100 (NAS100)

- DAX 40 (GER40)

- FTSE 100 (UK100)

- And many others

These indices respond well to technical analysis and are often preferred by short-term traders. Understanding each index’s behavior and economic factors is essential.

Popular Indices on OctaFX

- Dow Jones Industrial Index (US30): Includes 30 major U.S. companies. A good choice for traders looking for U.S. market volatility.

- Standard & Poor’s 500 (SPX500): Reflects the largest 500 U.S. companies and is a key indicator of the U.S. economy.

- NASDAQ 100 (NAS100): Focuses on tech-heavy industries, including companies like Apple and Microsoft.

- FTSE 100 (UK100): Includes the top 100 companies listed on the London Stock Exchange, making it a popular index for traders interested in the UK market.

Other notable indices you can trade on OctaFX include the DAX 40 (Germany), Nikkei 225 (Japan), and EURO STOXX 50 (Europe).

How to Start Trading Indices with OctaFX

- First, you’ll need to open an OctaFX MT5 trading account. If you’re new to trading, you can start with a demo account to practice.

- Once you have your account, make a deposit using your preferred method. You can trade indices with as little as a small deposit thanks to high leverage.

- After funding your account, you can choose an index to trade. Use the Market Watch on your platform to find the available indices.

- Use technical analysis tools like charts, indicators, and trend lines to understand price movements and make informed decisions.

- Once you’re ready, place your buy or sell order. You can set Stop Loss and Take Profit levels to manage your risk.

Octa Affiliate Program – Invite-a-Friend Program

OctaFX offers a fantastic Affiliate Program where you can earn money for inviting friends to trade with them.

How the Octa Invite-a-Friend Affiliate Program Works

- Log in to your Personal Area to get your unique referral link.

- Send your referral link via messengers like WhatsApp, Skype, or Telegram. You can also share it on social networks such as Facebook, Twitter, or Instagram.

- Earn Commissions:

- You will earn 1 USD for each standard lot traded by your referred friends.

- Your friends will also receive a 100% deposit bonus when they sign up.

- You can receive your commission every 24 hours or transfer it to your trading account.

Invite-a-Friend Program Conditions

- All OctaFX clients are eligible, except those already part of the IB referral program.

- The commission is based on the trading volume of the friends you refer.

- Valid Orders: The commission is paid for valid trades, which include:

- Trades that last for at least 180 seconds.

- Trades where the difference between the Open Price and Close Price is 30 points or more (3 pips in 4-digit precision).

- The order should not have been partially closed or closed by multiple closes.

- Commission Rate: You earn 1 USD per 1 standard lot traded.

- Wallet: The commission is credited to your Wallet within 24 hours, and you can transfer it to your trading account. The minimum transfer amount is 5 USD.

Additional Program Rules

- The Invite-a-Friend program is only available for new clients, excluding referrals of family members or self-referrals.

- Fraud Prevention: If any fraudulent activity is detected, your referral link may be deactivated.

- The company has the right to update or cancel the program and notify participants via Company news.

Octa Affiliate Program – Introducing Broker (IB)

If you’ve already invited all your friends and want to go further, you can apply to become an Introducing Broker (IB). IBs have the opportunity to refer new clients regularly and earn commissions for their activities, expanding their earnings even more.

Why Become an Octa Partner?

- Same Commission for All Assets: Earn the same competitive commission on all trading assets.

- Consistent Daily Commission Payouts: Get paid regularly, so you don’t have to wait for your earnings.

- More Than 25 Payment Methods: Choose from a wide range of payment methods for easy transactions.

- Up to $12 per Lot: You can earn up to $12 per lot, and receive up to 80% spread RevShare.

Calculate Your Earnings

Want to know how much you can earn? Use the Octa Profit Calculator to get an estimate of your monthly earnings based on the number of active clients you have. The more active clients you refer, the higher your commission.

For example:

- $12 per lot

- 61 active clients

- Earn $5,856 per month

Great for Traders, Perfect for Partners

Octa offers the best trading conditions for traders, making it easier for you to attract and retain clients:

- Low Spreads

- 50% Deposit Bonus

- No Trading Fees

- No Swaps

How to Get Started with Octa Affiliate Program (Introducing Broker)

- Become an Octa Partner: Apply to become an Introducing Broker today.

- Share Your Referral Link: Attract clients by sharing your unique referral link.

- Receive Daily Payouts: Enjoy the benefits of daily commission payouts based on your clients’ trading activity.

How to Join the Octa Forex Trading Contest

OctaFX offers exciting opportunities to win prizes through their Champion MT4 Demo Contest. If you’re looking to test your trading skills and win some amazing rewards, here’s how to join the next round.

Step 1: Register on OctaFX

First, you need to either log in to your existing OctaFX account or sign up for a new one. Signing up is quick and easy. Just make sure to provide your real details during registration, as using fake data may get you disqualified.

Step 2: Open a New Contest Account

Once you have logged into your OctaFX account, open a new Champion contest demo account. This account will be your official account for the contest.

Step 3: Download MT4 or Use the Browser Version

The contest is held on the MT4 platform. You can either download the MT4 trading platform to your computer or use the browser version for easy access.

Step 4: Wait for the Contest Start Date

The next round of the Champion MT4 Demo Contest starts on March 10, 2025. Mark the date and be ready to start trading as soon as the contest begins.

Step 5: Start Trading

Once the contest begins, use your contest account to start trading on MT4. The goal is to get the highest balance by the end of the contest.

Contest Prizes

The top 5 winners of the contest will receive the following prizes:

- 1st Place: $500

- 2nd Place: $300

- 3rd Place: $100

- 4th Place: $60

- 5th Place: $40

Contest Rules

- The contest runs for 4 weeks.

- Only participants who provide real data will be eligible to participate.

- Contestants must avoid cheating—such as using arbitrage trading or taking advantage of quote errors.

- You must register a new demo account for each round of the contest.

Important Information

- Account Type: MT4 demo account.

- Initial Deposit: $1,000 (virtual money for demo purposes).

- Leverage: 1:500.

- Trading Volume: Minimum of 0.01 lot, no maximum.

- Trading Tools: All trading techniques and EAs (Expert Advisors) are allowed.

How Winners Are Decided

The participant with the highest balance at the end of the contest will win the main prize. If two or more participants have the same balance, the prize will be shared equally.

Prize Withdrawal

- Winners can withdraw their prize into their Octa wallet.

- Claim your prize within a month after the contest ends, or you may lose your prize.

Join the Next Round

If you’re ready to test your skills, register now for the next Champion MT4 Demo Contest starting on March 10, 2025. This is your chance to trade, learn, and win exciting prizes.

If you have more questions, visit the OctaFX FAQ page for further details.

Here’s a streamlined explanation of how to start copying and earning with OctaFX’s Copy Trading feature:

How to Do Copy Trading on Octa in Nigeria

OctaFX Copy Trading allows you to copy expert traders automatically, saving you time and effort in creating your own strategies. You can choose from the best forex traders and diversify your trading portfolio.

Steps to Start Copy Trading on Octa in Nigeria

1. Create an OctaFX Account and Deposit Funds

Sign up on OctaFX and choose any payment method to deposit funds into your Wallet. If you already have funds in your trading account, you can use Internal Transfer to add them to your Wallet.

2. Follow the Best Traders

Browse through top traders (Masters) and select who you’d like to copy. Their trades will automatically be copied to your account. You can manage your portfolio by adjusting the deposit percentage for each trader. Experiment with different traders to find strategies that work for you.

3. Monitor and Profit

You have full control over the process. You can stop copying, unsubscribe, or modify the orders anytime. You can also view the detailed trading statistics of the traders you’re copying in your Copier Area.

Benefits of OctaFX Copy Trading?

- No Forex Experience Required: Start trading like a pro, even if you’re a beginner.

- Stable Income: Create a diversified portfolio for a more consistent income stream.

- Fast Order Execution: Your orders are executed in under 5ms after the Master Trader’s actions.

- Full Control: Modify or stop copying any trades at any time.

- Easy Setup: No extra verification needed to get started.

- Secure Withdrawals: Enjoy quick and safe withdrawals with popular payment methods.

How to Become a Master Copy Trader on OctaFX

If you’re an experienced trader, OctaFX offers you the opportunity to earn extra income by letting others copy your trades. Share your trading strategies, build your reputation, and attract followers who will copy your moves for a commission.

Steps to Become a Master Trader on OctaFX

1. Create a Master Account

Enter the Master Area and create your Master Account. You can either start fresh or use your existing trading account.

2. Set Up Your Account

Once you’ve created your Master Account, set up your profile by defining your commission amount and describing your trading strategy.

3. Earn and Track Your Profits

Use the Master Area to track your trading statistics, adjust your account settings, and monitor the commission you’ve earned from your followers.

Benefits of Being a Master on OctaFX?

- Earn Additional Income: As a Master Trader, you can earn extra income by allowing others to copy your trades.

- Flexibility: Create multiple Master Accounts for different strategies and appeal to a broader audience.

- Track Earnings: Access detailed statistics to track your orders and commission earned through the Master Area.

- Safe and Fast Transactions: OctaFX ensures secure deposits and withdrawals with popular payment methods available.

Octa Trading Fees and Commissions

When reviewing a broker like Octa, it’s also key to understand the fees involved in your trading activities. These fees can have a significant impact on your profitability, especially if you’re a high-volume trader.

Let’s break down Octa’s fees, both trading and non-trading, to see how competitive their fee structure is in 2025.

Overview of Octa Fees and Charges

Octa operates with a commission-free trading environment, which means traders don’t need to pay commissions. Instead, they add markups on raw spreads, making it easy for traders to access competitive pricing without worrying about commission fees.

Here’s a quick overview of the key fees:

- Spreads: Octa offers a spread starting at 0.6 pips for Forex trades, with major currency pairs averaging around 1.0 pips. For cryptocurrencies, the spread starts at 0.6 pips, and the average cost is 2.8 pips.

- Commission: There is no commission at Octa—trading costs are embedded in the spread.

- Swap Rates: Octa does not charge swap rates for leveraged overnight positions, which is a key feature that sets them apart from other brokers.

- Currency Conversion Fees: This fee applies when trading different currencies from the base currency of your account. Octa adds a markup over the market spread for currency conversion.

Main Trading Fees at Octa

1. Forex Trading Fees:Spread: Starts at 0.6 pips.

- Commission: $0.

- Total Cost: $6 per 1.0 standard round lot.

2. Equities Trading Fees

- Spread: 0.6 pips.

- Commission: $0.

- Total Cost: $6 per 1.0 standard round lot.

3. Cryptocurrency Trading Fees

- Spread: 0.6 pips.

- Commission: $0.

- Total Cost: $6 per 1.0 standard round lot.

4. Commodities Trading Fees

- Spread: Between 0.3 pips to 1.7 pips.

- Commission: $0.

- Total Cost: $3 to $17 per 1.0 standard round lot.

5. Indices Trading Fees

- Spread: 0.2 pips.

- Commission: $0.

- Total Cost: $2 per 1.0 standard round lot.

Non-Trading Fees at Octa

Octa’s non-trading fees are minimal, making it a more affordable broker for traders looking to avoid hidden charges. Here’s what you need to know:

- Deposit Fee: Octa does not charge any internal fees for deposits. However, third-party payment processing fees, such as blockchain or currency conversion fees, may apply.

- Withdrawal Fee: There are no internal withdrawal fees at Octa. However, third-party charges may apply, particularly for blockchain transactions or currency conversions.

- Inactivity Fee: Octa does not impose an inactivity fee, which means traders aren’t pressured into making trades to avoid fees.

FAQs on How To Trade On Octa In Nigeria – OctaFX Review 2025

1. What is OCTA trading?

OCTA trading refers to the trading services provided by Octa, formerly known as OctaFX, which offers access to multiple financial markets such as Forex, crypto, stocks, commodities, and indices. By using Octa, traders can trade with competitive spreads, no swap rates, and a user-friendly platform like MT5, or OctaTrader. Whether you’re looking to trade Forex or Octa crypto trading, this platform provides all the tools you need.

2. Is trading OCTA real or fake?

Trading on Octa is 100% real and legitimate. Octa is a licensed and regulated broker with global reach, offering trading services in major financial markets including Forex, crypto, indices, commodities, and energies. As an authorized broker under regulations like CySEC and FSCA, Octa ensures a secure environment for traders to use Octa for trading.

3. What is OCTA used for?

Octa is used for online trading in various financial markets, including Forex, crypto, indices, commodities, and energies. You can use Octa to trade on Octa’s platform (MT5, or OctaTrader), where you can access a wide range of assets and take advantage of competitive spreads, no overnight swap fees, and copy trading features.

4. Is Octafx safe to use?

Yes, Octa is safe to use. It is regulated by trusted authorities such as CySEC, FSCA, and MISA, ensuring your funds are secure. Additionally, Octa uses advanced security protocols like SSL encryption, negative balance protection, and segregated client accounts, making it a safe choice for Octa forex trading and other market activities.

5. How do I trade on OctaFX in Nigeria?

To trade on Octa in Nigeria, you need to sign up for an account on their website, deposit funds (starting at $25), and choose the platform (MT5 or OctaTrader) you prefer to use. You can then access various markets, including Forex, Octa crypto trading, commodities, and more. Follow the Octa broker review to understand the process thoroughly.

6. Does OctaFX have fees?

OctaFX has competitive fees, including spreads starting from 0.6 pips for Forex. They do not charge commissions or swap rates for overnight positions, which makes trading on Octa more affordable. Other fees may apply for currency conversions, and third-party charges may be incurred for deposits or withdrawals.

7. How much is the OctaFX withdrawal fee?

Octa does not charge internal withdrawal fees. However, third-party payment processors, such as blockchain and currency conversion services, may apply fees when withdrawing funds from your Octa account. Check the payment method you choose for any additional charges.

8. How much is 0.01 lot in OctaFX?

In OctaFX, 0.01 lot in Forex trading typically costs $0.10 per pip depending on the currency pair and market conditions. This applies to Octa forex trading, and the cost may vary for other asset classes like Octa crypto trading or Octa commodities trading.

9. Does OctaFX charge overnight fees?

Octa does not charge swap or overnight fees for leveraged positions. This is one of the advantages of using Octa, especially for those who trade on Octa in Nigeria, as it allows traders to hold positions without worrying about extra charges for overnight trades.

10. How much is the OctaFX minimum deposit in Nigeria?

The minimum deposit on Octa for Nigerian traders is $25. You can deposit funds into your Octa account using various payment methods, including bank transfers, e-wallets, and cryptocurrencies.

11. Does Octa work in Nigeria?

Yes, Octa works in Nigeria. Nigerian traders can use Octa to trade in Forex, Octa crypto trading, commodities, indices, and more. The platform supports local payment options, including deposits on Octa via local bank transfers.

12. Which trading platform is the best in Nigeria?

The best trading platform in Nigeria depends on your preferences. Octa offers MT5, and OctaTrader, all of which are popular for Octa forex trading and Octa crypto trading. You can choose the platform that suits your trading style, whether you’re a beginner or an advanced trader.

13. How much do I need to trade on OctaFX?

To start trading on OctaFX, you need a minimum deposit of around $25. With this deposit, you can access various financial markets, including Octa forex trading, Octa crypto trading, commodities, and indices.

14. How to create an account in OctaFX?

To create an account in OctaFX, visit their website, click on the registration button, and fill in the required details. Once registered, you can log into your account, deposit funds, and start trading in Forex, Octa crypto trading, and more.

15. How to start OctaFX for beginners?

Beginners can start trading on OctaFX by creating an account, depositing funds (as low as $25), and choosing a platform like MT5 or OctaTrader. It’s recommended to start with a demo account, explore Octa forex trading, and learn from experienced traders before going live.

16. What is the minimum amount to start OctaFX?

The minimum amount required to start Octa forex trading is about $25. This deposit gives you access to trade in various financial markets, including Octa crypto trading, commodities, and indices.

17. Can I trade on OctaFX without verification?

No, you cannot trade on OctaFX without verification. To comply with regulatory requirements and ensure the security of your account, Octa requires traders to complete KYC verification before they can start trading on Octa forex trading or Octa crypto trading.

18. How do I verify my OctaFX account?

To verify your OctaFX account, you need to submit proof of identity (such as a passport or ID card) and proof of address (such as a utility bill or bank statement). Once submitted, Octa’s support team will review your documents and complete the verification process.

19. How can I verify KYC?

You can verify your KYC on Octa by submitting the required documents (ID and address proof) through the account verification section. After submission, Octa will review your documents and verify your account for Octa forex trading.

20. Can I use OctaFX without verification?

No, you cannot use OctaFX without completing the KYC verification process. Verification is required for security and regulatory compliance before you can deposit on Octa and start trading in Forex, crypto, and other financial markets.

21. How to activate OctaFX account?

To activate your OctaFX account, complete the registration and verification process. Once your documents are verified, you can make your first deposit and start trading in the markets you prefer.

22. How do I deposit money into my trading account?

To deposit money into your Octa trading account, log in to your Octa account, go to the deposit section, and select a payment method. Octa supports various deposit methods, including local bank transfers, e-wallets, and cryptocurrency payments.

23. What is the minimum deposit on OctaFX?

The minimum deposit on OctaFX is around $25. This allows you to start trading in Forex, Octa crypto trading, and other markets available on the platform.

24. How to trade on Octa for beginners?

To trade on Octa as a beginner, start by signing up for an account, depositing funds, and selecting the platform that suits your needs, such as MT5 or OctaTrader. Practice with a demo account, learn about the markets (Forex, crypto, indices, stocks and commodities), and gradually start trading with real money.

25. How much money can we withdraw from OctaFX?

You can withdraw as much as you like from your OctaFX account, provided your account balance covers the withdrawal amount. Keep in mind that third-party fees may apply, depending on your withdrawal method.

26. Can we withdraw money from OctaFX?

Yes, you can withdraw money from OctaFX to your linked account. Octa offers various withdrawal methods, including bank transfers, e-wallets, and cryptocurrency transfers.

27. Can I withdraw from OctaFX without verification?

No, you cannot withdraw from OctaFX without completing the verification process. This is necessary for security and regulatory compliance.

28. How do I withdraw money from my trading account?

To withdraw money from your Octa trading account, go to the withdrawal section of the platform, choose your preferred payment method, and enter the amount you want to withdraw. Follow the prompts to complete the transaction.

29. How to add a bank account in OctaFX?

To add a bank account to your OctaFX profile, go to the payment methods section in your account, select the bank transfer option, and enter your bank details. Once added, you can deposit on Octa or withdraw funds to your bank.

30. Which OctaFX account type is best for trading?

The best OctaFX account type depends on your trading preferences.

31. How to start trading on OctaFX as a beginner?

To start trading on OctaFX as a beginner, sign up for an account, deposit the minimum amount, and practice on a demo account. Once you’re comfortable, start trading with real money in markets like Octa forex trading, Octa crypto trading, Octa energies trading, Octa stocks trading, Octa indices trading or Octa commodities trading.

32. How do you trade successfully on OctaFX?

To trade successfully on OctaFX, start by learning the basics, using tools like demo accounts, researching market trends, and managing risks. You can also use Octa copy trading to follow expert traders and improve your trading results.

33. How can I use OctaFX to make money?

You can use OctaFX to make money by trading on its various markets like Forex, Octa crypto trading, stocks, and commodities. You can also earn by becoming a Master trader on Octa copy trading, where others copy your trades for a commission.

34. How should a beginner start trading on Octa Broker?

A beginner should start by creating an account, using a demo account to practice, and then making their first deposit to trade live. Start with Octa forex trading or Octa crypto trading to get familiar with the platform.

35. How can I become a copy trader on OctaFX?

To become a copy trader on OctaFX, sign up for an account, choose a Master trader to copy, and set the percentage of your portfolio to be copied. You can start by copying multiple strategies for diversified profits.

36. How much does OctaFX charge per trade?

OctaFX charges a trading fee through the spread, which is typically around 0.6 pips for Forex. There is no commission per trade, and Octa’s trading fees are competitive compared to other brokers.

37. What are the OctaFX trading fees?

OctaFX trading fees consist of spreads, starting from 0.6 pips for Forex. There are no commission fees or swap rates, making it a cost-effective choice for traders.

38. How much is 0.01 lot in OctaFX?

A 0.01 lot trade in OctaFX typically costs $0.10 per pip for Forex pairs. The cost may vary depending on the market conditions and assets you trade on Octa broker.

39. How much do I need to start trading on OctaFX?

You need about $25 to start trading on OctaFX. This deposit will allow you to trade in Octa forex trading, Octa crypto trading, and other available markets.

40. What financial markets can I trade on Octa as a Nigerian trader?

As a Nigerian trader, you can trade in all 5 major financial markets on Octa, including Forex, crypto, stocks, commodities, and indices. You can trade 52 currency pairs, gold and silver, 3 energies, 10 indices, 34 cryptocurrencies, and 150 stocks.

As a Nigerian trader, you can trade all 5 major financial markets on Octa, including Forex, crypto, stocks, commodities, and indices. You can trade 52 currency pairs, gold and silver, 3 energies, 10 indices, 34 cryptocurrencies, and 150 stocks.

Pingback: 15 Fastest Ways to Make Money Online in Nigeria in 2025 - AllenVest

It’s super easy to get hooked on Octa in a good way, it’s a decent broker and once you get in you will find all you need here,

They sure have a lot of payment methods there… I used to transfer money to my ex-broker through p2p crypto, which is kinda crazy now that I think about it now.

Should’ve read one of these Octa reviews earlier, smh

Thank you for your contribution

yeah , fine broker as most of Octa reviews I cheched were very positive, no wonder – tight spreads and overall very stable plaform that has great ui

i recently came to know that the broker has several branches, I mean there are several entities that operate unedr one unified Octa brand…I think it is actually good , kinda rises the legitimacy as the broker has to comply with different regulations.

The broker’s ai tools are smth that have gained attention …have not tried it yet. How effective is the integrated ai tool for pattern recogntition?